Cost of Investing

At Unified Advisory Group, you receive truly integrated wealth management services that are professional, methodical, and firmly rooted in understanding your personal needs.

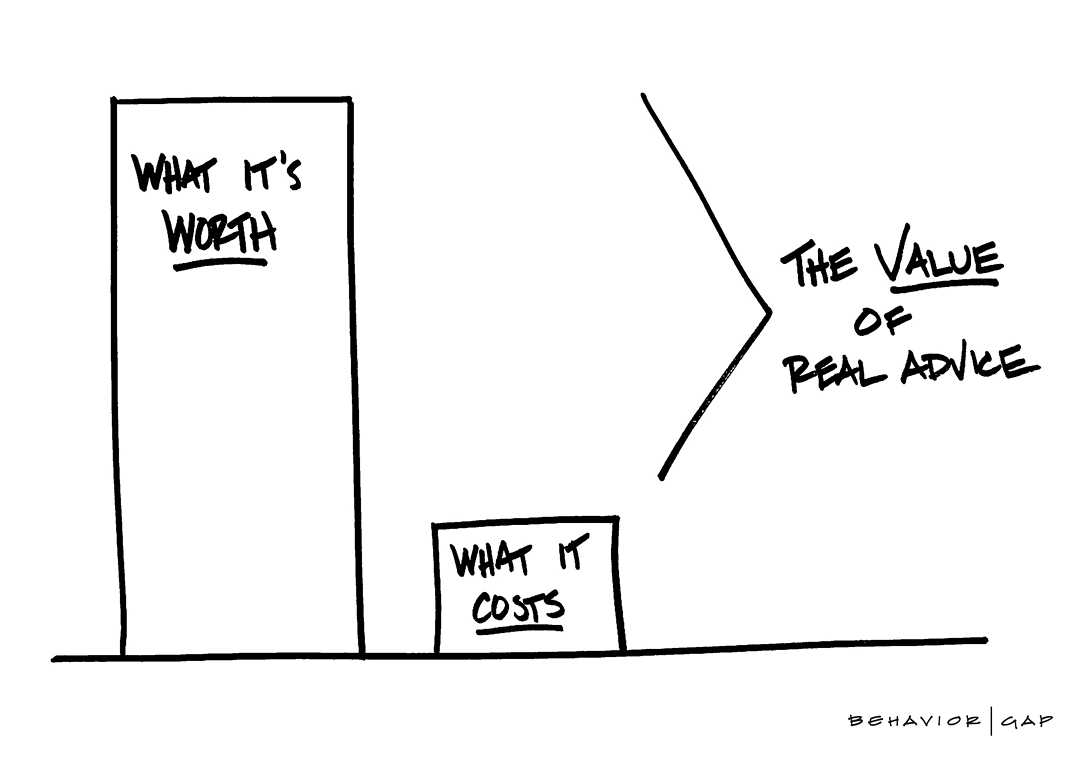

It’s important that you understand what you pay for your investments and our advice, and the value added by our team. We firmly believe that full transparency is important for all clients, and we have done this for many years.

The media may mislead by suggesting that “your funds cost you 2.00% and up”. They fail to mention that what you pay includes both:

- the “cost of investing” and

- the “cost of advice”

Our goal is always to review both, at the time you first engage us, and every two to three years thereafter.

What do you pay and for what?

The “cost of investing” includes the costs of your investment portfolio (in pools, mutual funds, ETFs, or alternative products), rebalancing, tax optimization, hedging, and other advanced features.

The “cost of investing” includes the costs of your investment portfolio (in pools, mutual funds, ETFs, or alternative products), rebalancing, tax optimization, hedging, and other advanced features.

The “cost of advice” includes the advice and planning from your Advisor, support from our team, and Assante’s compensation for providing oversight, reporting, and regulatory services.

All returns reported on client statements are always net of all costs. We disclose all of the above, as it applies to you, in a document we refer to as CRM2 – Disclosing the Cost of Investing and the Cost of Advice.

We provide a detailed review of all the costs associated with your accounts, using both percentages and dollars. We firmly believe that full transparency is important for all clients. We’ll go over the breakdown of cost between investing and advice, and answer any questions you have.

*Our costs are a function of the complexity of the client’s situation and what exactly their service needs are. Once we understand your situation better, and prior to us moving forward, we will provide you with a specific quote.

Christian Battistelli CFP®

Senior Wealth Advisor

Catherine Jones BBM, CDFA, CFP®

Senior Financial Advisor

Mike Gomes CFP®

Senior Wealth Advisor

Stephen Jones CPA, CA, CFP®

Senior Financial Advisor

Lynley Schwartzentruber CFP®

Senior Wealth Advisor

Mutual fund products, investment services and recommendations are offered through CI Assante Wealth Management Ltd. Insurance products and services are provided through Assante Estate and Insurance Services Inc. Wealth planning services may be provided by an accredited Assante advisor or through CI Assante Private Client, a division of CI Private Counsel LP, or a non-affiliated third party.

CI Assante Wealth Management Ltd. is a Member of the Canadian Investment Regulatory Organization and Canadian Investor Protection Fund (excluding Quebec).

© 2025 CI Assante Wealth Management. All Rights Reserved.