The Unified Advisory Group Approach

As your financial guides in an ever-changing landscape, Unified Advisory Group offers comprehensive levels of service designed to meet the unique requirements of each client. Unified Advisory Group focuses on clients who value working with one team to coordinate all of their financial needs, such as:

- busy families

- clients in complex situations

- experienced investors

- business owners

- retired clients who want to ensure their investments last a lifetime and beyond

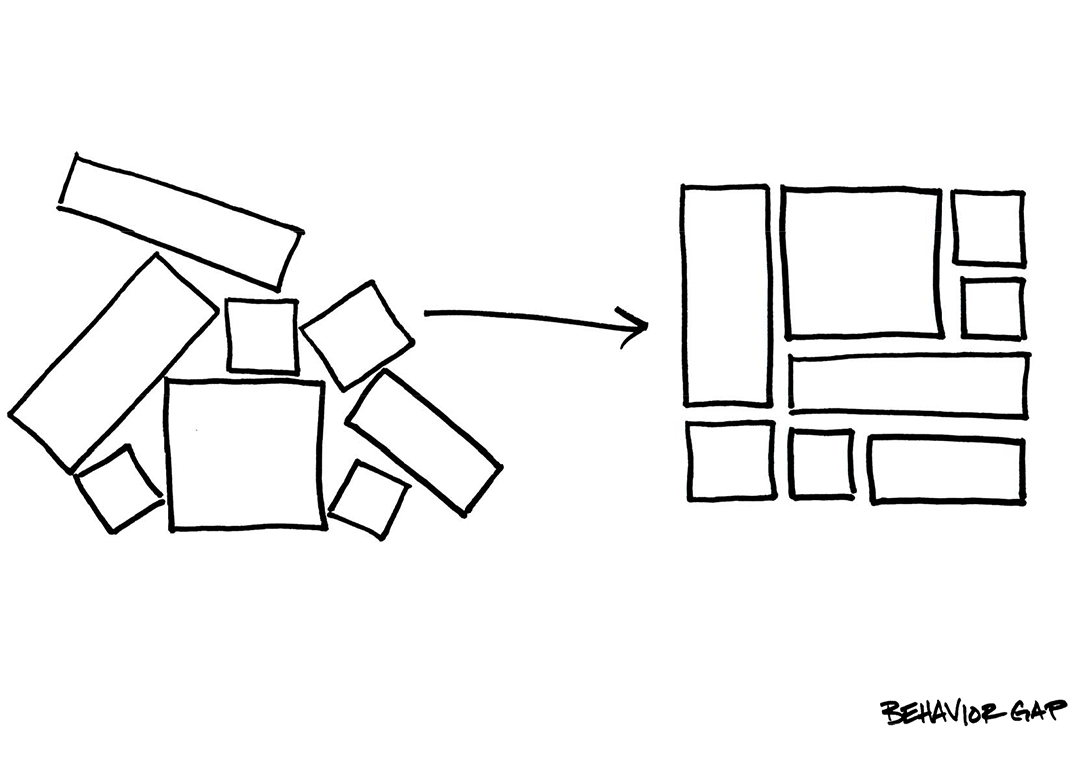

Each client is partnered with the Advisor whose expertise is the best fit for their needs. An appropriate service plan is adopted to help clients reach their individual goals & dreams using five main areas of financial planning:

1. Retirement and Cash Flow Planning

Strategy, discipline and long-range planning are all well and good, but you can’t put life on hold. What about right here and now?

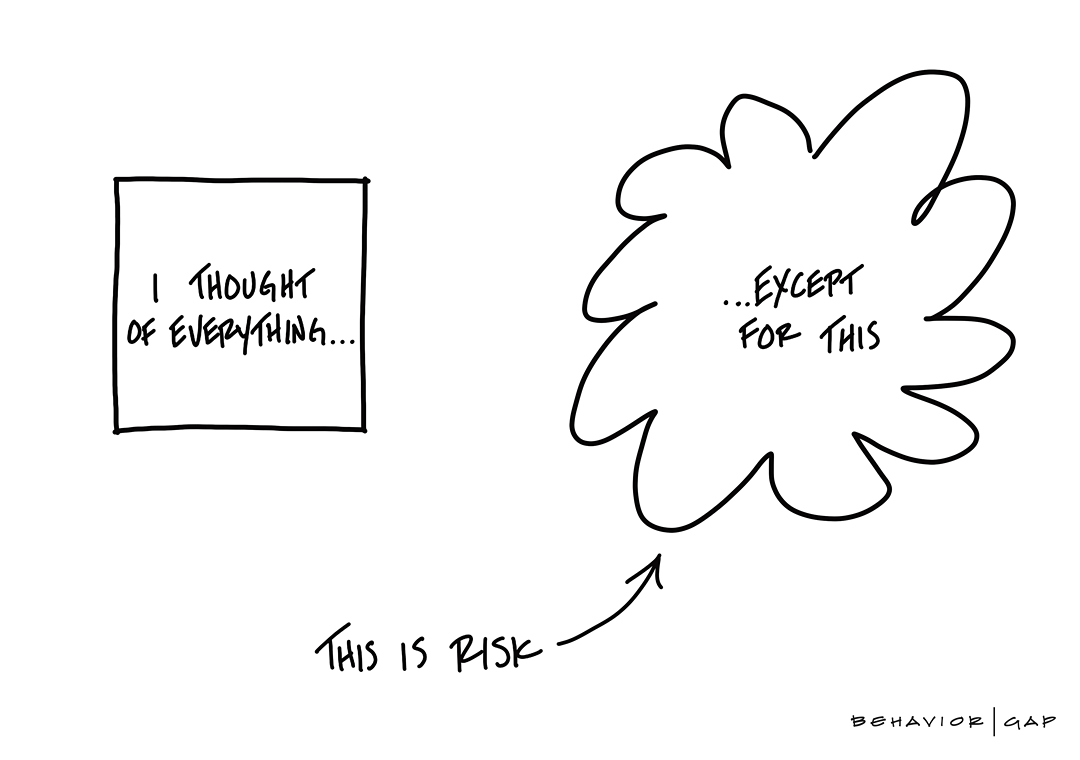

2. Risk Management

Should I have insurance? How much coverage should I have? What type of insurance do I need? Will my family be okay if the unexpected happens?

3. Investment Strategy

Am I invested in the right portfolios given my goals, timeframes, and risk preferences? Should my investment strategy change over time? How do I manage when markets are scary?

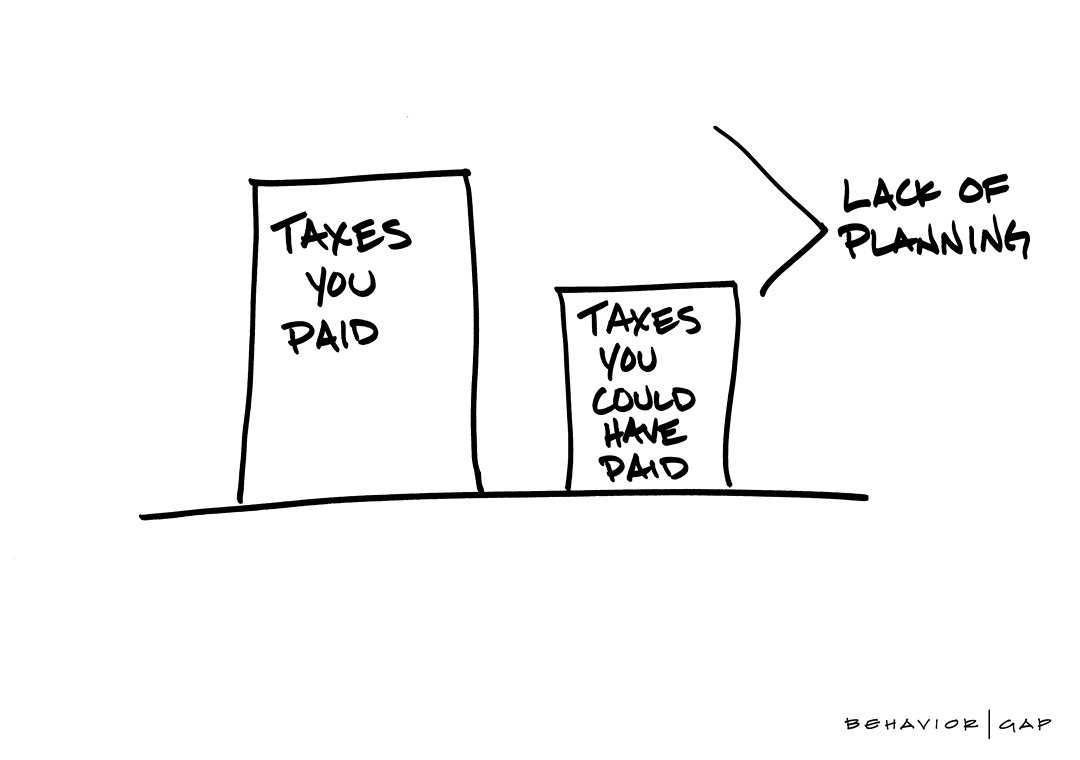

4. Tax Management

How do I pay less tax over my lifetime? How do I make sure my investments are tax-efficient? What do I need to know about the Disability Tax Credit?

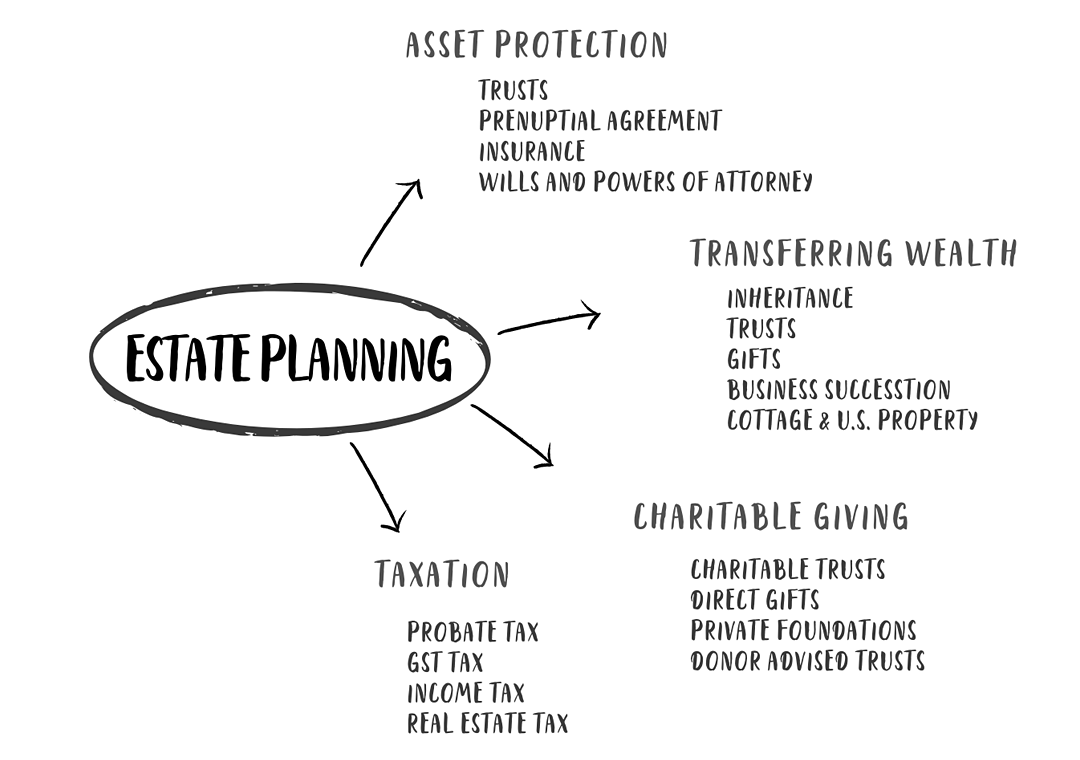

5. Estate Planning

Am I saving enough and in the right places? When can I retire? How long will my money last? When should I take my government benefits?

Christian Battistelli CFP®

Senior Wealth Advisor

Catherine Jones BBM, CDFA, CFP®

Senior Financial Advisor

Mike Gomes CFP®

Senior Wealth Advisor

Stephen Jones CPA, CA, CFP®

Senior Financial Advisor

Lynley Schwartzentruber CFP®

Senior Wealth Advisor

Mutual fund products, investment services and recommendations are offered through Assante Financial Management Ltd. Insurance products and services are provided through Assante Estate and Insurance Services Inc. Wealth planning services may be provided by an accredited Assante advisor or through CI Assante Private Client, a division of CI Private Counsel LP, or a non-affiliated third party.

Assante Financial Management Ltd. is a Member of the Canadian Investment Regulatory Organization and Canadian Investor Protection Fund (excluding Quebec).

© 2025 CI Assante Wealth Management. All Rights Reserved.